Context

You can generate T4 amounts for your employees for a selected calendar year. These T4s can be printed onto plain paper with the latest CRA forms automatically included with your data.

By default, the T4 generated is based on an employee agent's gross commission paid, and automatically deducts their transaction fees.

Click here to watch a video.

Steps

When you select a new tax year (one that has never been accessed for preparing T4s before), you are asked to finalize the year that is currently active. Finalizing the tax year stores the data from the previous year (including manual edits, tax form images, and tax form positions) as Read-only information. See "Working in Prior Tax Years" below for more details.

You can unfinalize any tax year. However, it is strongly recommended that you do not unfinalize tax years that have been submitted to the CRA unless absolutely necessary. See "Unfinalize Prior Years" below for more details.

The instructions that follow assume you are working in the active tax year. That is, the latest year that has been accessed. All prior years are finalized as read-only information.

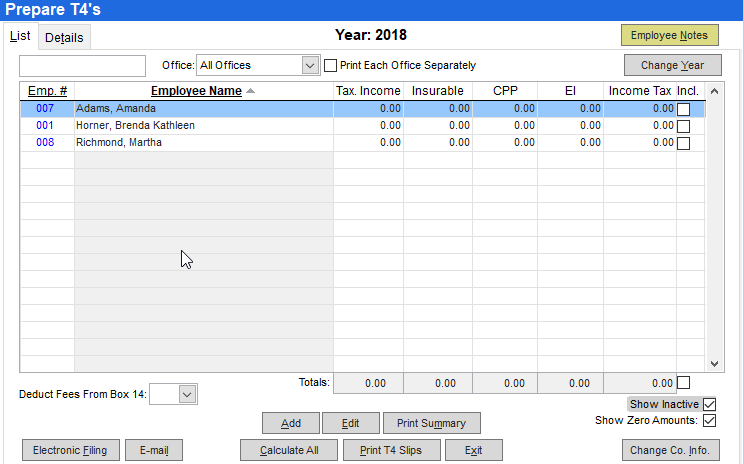

- Navigate to Payroll > Payroll Utilities Menu, and select 9.5.3 - Prepare T4s.

- By default, the tax year that was worked on most recently is displayed. From here, you can:

- Continue working in the tax year that is currently displayed.

- Click Change Year to access a prior tax year.

- Click Change Year to access a subsequent tax year.

- Click Calculate All to generate T4 figures.

-

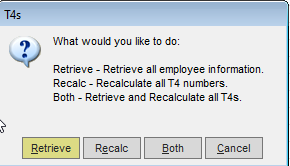

Click one of the following:

- Retrieve, to retrieve information for all employees.

- Recalc, to recalculate T4 figures for all employees. Recalculating overwrites any manual changes you have made.

- Both, to retrieve the information and recalculate T4 figures for all employees. Recalculating overwrites any manual changes you have made. Note: The first time you generate the figures, you must select Both to retrieve and calculate the T4 figures for the new, active year.

- Use the Deduct Fees From Box 14 dropdown to specify if you want to deduct fees from the agent's gross. You are prompted to re-calculate all T4 numbers in order for the change to be applied.

If you choose No, Back Office generates T4s for the gross commission paid to the agent.

If you choose Yes, Back Office looks at all fees set that have the Deduct from T4A/T4s field set to Yes, and deducts those from the agent's gross commission for the T4 calculation.

- After the T4 numbers are generated, you can make any necessary adjustments for an employee by selecting the employee and clicking Edit. When you have made manual adjustments, re-calculating overwrites your manual changes.

Next steps

You are now ready to print and electronically file the T4s.

Working in prior tax years

Starting with the 2014 or 2015 tax year, depending on when you changed the tax year from 2014 to 2015, tax data for each year is stored (including manual edits, tax form images, and tax form positions). This data can be viewed in the T4 by selecting Change Year, and rolling the year back to the applicable year. No tax data before 2014/2015 is stored here. However, you can use the Staff Payroll History report to generate the figures for the years prior to 2014/2015.

Un-finalize prior years

It is strongly recommended that you do not un-finalize or recalculate tax years that have been submitted to the CRA.

If you un-finalize a tax year, and changes have been made to settings that affect tax slip calculation since that year was finalized, you may not be able to recalculate the same results that were submitted to the CRA. If it is necessary to unfinalize a tax year to make corrections, you should avoid using the Recalculate option unless absolutely necessary. Instead, make manual corrections as required.

To change a tax year from finalized:

- Navigate to Payroll > Payroll Utilities Menu, select 9.5.3 - Prepare T4s, and click Change Year.

- Select the applicable tax year.

- Click Finalize.

- Confirm your decision, twice.

An unfinalized prior year automatically re-finalizes when you change the tax year, or close the window.

Related articles