Context

If you have 50 or more T4As to file, CRA specifies that you must e-file.

Steps

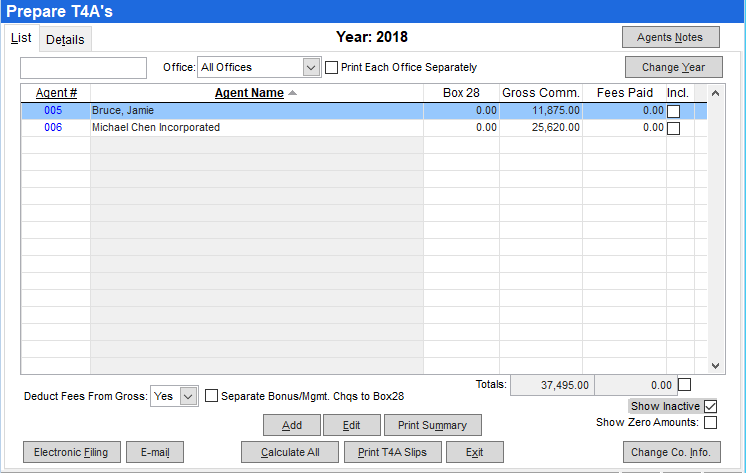

- Navigate to Staff Payroll > Payroll Utilities Menu, and select 9.5.4 - Prepare T4As.

- Click Electronic Filing.

- When you click on Electronic Filing, you may be prompted to enter your company's business number. If so, navigate to the company profile (Executive > Company Setup > Edit Company Profile), click the Misc tab, and enter the business number in the Payroll # field. The format for the payroll number is #########RP#### (9 digits, RP, 4 digits). If you are blocked because an invalid Business Number has been reported, please call 1-800-959-5525 to verify your number is valid with Canada Revenue Agency Business Number Information.

- You may also be prompted to download a MSXML driver. You must say Yes to this prompt in order for the Magnetic Media option to work. When you choose Yes, you are directed to our website and the driver download automatically begins. Your anti-virus or firewall software may require you to authorize the download of this file.

- You are prompted to select a directory to save the file. You can save it to your hard drive and move it to disk later, or you can save it directly to the media you are sending.

- After you select the target directory, click Select. The name of the file created is displayed. Take note of the path and file name for future reference.

Next steps

After you have completed the steps above, you have created the file. For further submission instructions, visit the Revenue Canada website: https://www.canada.ca/en/revenue-agency.html

Related articles